If the employee fails to submit evidence of medical bills, they will receive the Allowance, but it will be fully taxed. However, the employee only receives this amount on submitting medical bills as proof. One can save income tax on medical allowance. Medical Allowance is the amount an employer pays an employee for medical expenses during the term of the employment. One can save income tax on conveyance allowance. It appears on the earnings side of the salary slip.

Hence is exempt from tax up to a specific limit. It appears on the earnings side of the salary slip.Ĭonveyance Allowance is the amount an employer pays an employee to travel to and from work. Since housing rent allowance is an allowance, it is exempted from tax up to a specific limit, provided the employee pays the rent. It is 40 per cent of the basic pay for all other cities. HRA is 50 per cent of the basic pay for a metro city. The HRA depends on the city of residence of the employee. House Rent Allowance (HRA) is given to employees living in rented facilities. It appears on the earnings side of the pay slip right after the basic pay. For income tax, basic and DA are considered as pay.

Hence it is different for different locations. Dearness allowance is directly based on the cost of living. It is usually 30-40 per cent of the basic pay. It is paid to offset the impact of inflation on one's pay. Basic is the first component on the earnings side of the salary slip. The salary is 100 per cent taxable in the hands of the employee. Organisations tend to keep the basic component low so the allowance pay won't be topped. As the employee grows, other allowances tend to be higher. At junior levels, the basic tends to be high.

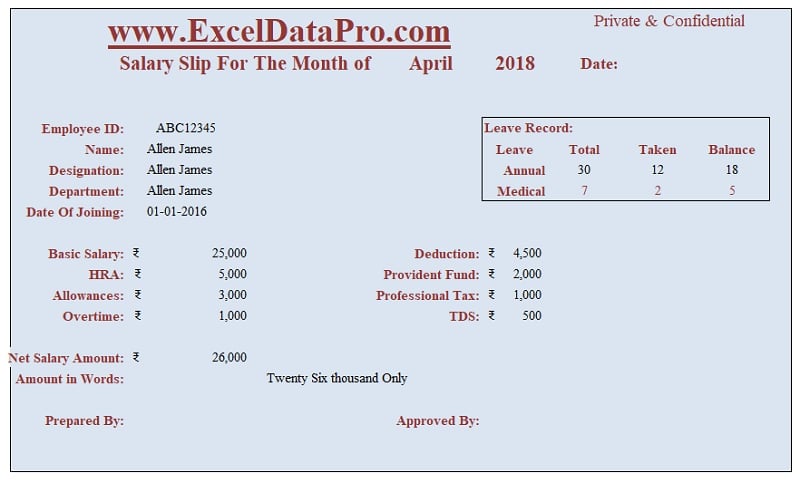

It forms the basis of other components of the salary. It constitutes 35-50 per cent of the salary. The income part of the salary slip has basic salary and allowances. Salary's components primarily fall under income or Earnings and Deductions. Let us now try and understand every component of a salary slip.Ī salary or pay slip contains basic information like the company's name, employee's name, designation and the employee's code. Let us understand what its important components are:īroad components are given below that form part of the income or earnings in the salary statement or the pay slip:īasic Salary, Dearness Allowance, House Rent Allowance, Conveyance Allowance, Medical Allowance, Special Allowance, Professional tax, TDS (Tax Deducted at Source) and Employee Provident Fund A salary slip is one of the most important documents for an employee. The document which includes all such details is called a salary slip or pay slip.

0 kommentar(er)

0 kommentar(er)